The new year is just around the corner, and a lot has changed in the world of Payoneer over the last twelve months. Over the last few months, they have unveiled a number of different ways to load your card - which we covered by this blog post on how to load your Payoneer card in Pakistan.

While nothing has changed on that end since that last blog post, plenty has changed since we published our incredibly popular guide on how to use Payoneer in Pakistan in 2015. Luckily, we have just the answer for you - an updated guide on how to use Payoneer in Pakistan in 2016!

WHAT IS PAYONEER?

Payoneer offers an incredible payment solution for those who receive money from Payoneer affiliates. Payoneer in Pakistan is a particularly beneficial option since the world's most popular payment option Paypal is not generally available in Pakistan.

Avid followers of this blog, if there are any, will already know that Payoneer is a payment solution company that issues Prepaid MasterCard Debit Cards to freelancers and other people receiving income from foreign countries.

Payoneer cards can be used in Pakistan. How it works is that you receive money through a number of Payoneer partners (including Freelancer.com, oDesk.com, Elance.com etc). Once the money is loaded onto your card

You can sign up for a Payoneer card in Pakistan by clicking here (free $25 bonus once you load $100 to your card)

WHAT ARE THE ADVANTAGES OF USING PAYONEER?

Since Paypal is not available in Pakistan, Payoneer remains the most reliable way to receive money from clients abroad. Although at times you may feel like the fees are high, you are guaranteed on-time money (within 2 hours of loading if urgent load option is selected).

You can withdraw money from select ATMs across Pakistan, or use the money at POS terminals at petrol pumps, shops, restaurants and other vendors. If you decide to go for Payoneer, you don't have to rely on local banks, which have a habit of charging hidden fees.

HOW DO YOU SIGN UP FOR PAYONEER IN PAKISTAN?

You can either sign up for Payoneer by clicking here (annual charge instead of monthly charge + $25 bonus once you load $100 to your card)

WHAT ARE THE PAYONEER FEES?

Below is the fee table for the card if you decide to order from this site. If you decide to order it through a specific partner, check out the fees for that specific card when applying for it. Most cards have the same fee structure, except instead of an annual fee of $29.95, they have a monthly fee of $3 (totalling to $36 per year).

You can sign up for a Payoneer card in Pakistan by clicking here (free $25 bonus once you load $100 to your card)

HOW LONG DOES IT TAKE TO SHIP PAYONEER CARD TO PAKISTAN?

We did a survey and found that the average time it takes to ship Payoneer card to Pakistan is less than 25 calendar days. This means that if you select regular shipping option, you can get your card within the calendar month.

A large number of people got their cards within 20 days, but for some exceptional cases, it took as many as 40 days..

If you need your card urgently, you can pay extra and have it couriered to you within three working days. However, in order to do this, you have to pay a hefty fee to have it couriered directly to you.

If you have been waiting for long for a Payoneer card (over three months), do contact Payoneer and ask them to send you a new one. Don't be impatient though - if you call for a new card and receive the one shipped to you first, that will be blocked and you won't be able to activate it.

HOW TO USE PAYONEER IN PAKISTAN IN 2015?

We have written in great detail about how to use Payoneer in Pakistan before, but since those posts are quite old now, we decided to write a new post about how to use Payoneer in Pakistan in 2016.

Once you apply for the Payoneer card here:

1. ACTIVATE YOUR PAYONEER IN PAKISTAN

WHAT IS THE PAYONEER IN PAKISTAN TRANSACTION LIMIT?

While nothing has changed on that end since that last blog post, plenty has changed since we published our incredibly popular guide on how to use Payoneer in Pakistan in 2015. Luckily, we have just the answer for you - an updated guide on how to use Payoneer in Pakistan in 2016!

WHAT IS PAYONEER?

Payoneer offers an incredible payment solution for those who receive money from Payoneer affiliates. Payoneer in Pakistan is a particularly beneficial option since the world's most popular payment option Paypal is not generally available in Pakistan.

Avid followers of this blog, if there are any, will already know that Payoneer is a payment solution company that issues Prepaid MasterCard Debit Cards to freelancers and other people receiving income from foreign countries.

|

| Payoneer.com |

Payoneer cards can be used in Pakistan. How it works is that you receive money through a number of Payoneer partners (including Freelancer.com, oDesk.com, Elance.com etc). Once the money is loaded onto your card

You can sign up for a Payoneer card in Pakistan by clicking here (free $25 bonus once you load $100 to your card)

WHAT ARE THE ADVANTAGES OF USING PAYONEER?

Since Paypal is not available in Pakistan, Payoneer remains the most reliable way to receive money from clients abroad. Although at times you may feel like the fees are high, you are guaranteed on-time money (within 2 hours of loading if urgent load option is selected).

|

| Source: Payoneer.com |

You can withdraw money from select ATMs across Pakistan, or use the money at POS terminals at petrol pumps, shops, restaurants and other vendors. If you decide to go for Payoneer, you don't have to rely on local banks, which have a habit of charging hidden fees.

HOW DO YOU SIGN UP FOR PAYONEER IN PAKISTAN?

You can either sign up for Payoneer by clicking here (annual charge instead of monthly charge + $25 bonus once you load $100 to your card)

OR

you can sign up directly through your Payoneer partner and pay a monthly fee and receive no bonus.

OR

you can directly sign up on the Payoneer website.

WHAT ARE THE PAYONEER FEES?

Below is the fee table for the card if you decide to order from this site. If you decide to order it through a specific partner, check out the fees for that specific card when applying for it. Most cards have the same fee structure, except instead of an annual fee of $29.95, they have a monthly fee of $3 (totalling to $36 per year).

|

| Payoneer in Pakistan Fee Chart (Source: Payoneer.com) |

You can sign up for a Payoneer card in Pakistan by clicking here (free $25 bonus once you load $100 to your card)

HOW LONG DOES IT TAKE TO SHIP PAYONEER CARD TO PAKISTAN?

We did a survey and found that the average time it takes to ship Payoneer card to Pakistan is less than 25 calendar days. This means that if you select regular shipping option, you can get your card within the calendar month.

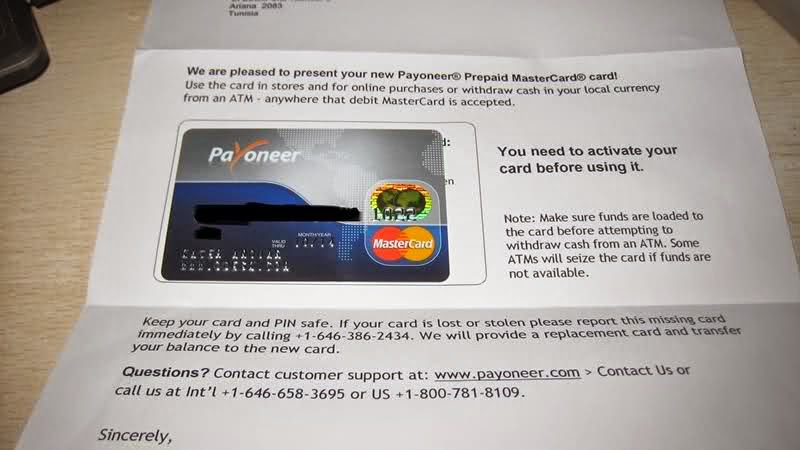

|

| Image taken from smashingsoftwares.blogspot.com |

A large number of people got their cards within 20 days, but for some exceptional cases, it took as many as 40 days..

If you need your card urgently, you can pay extra and have it couriered to you within three working days. However, in order to do this, you have to pay a hefty fee to have it couriered directly to you.

If you have been waiting for long for a Payoneer card (over three months), do contact Payoneer and ask them to send you a new one. Don't be impatient though - if you call for a new card and receive the one shipped to you first, that will be blocked and you won't be able to activate it.

HOW TO USE PAYONEER IN PAKISTAN IN 2015?

We have written in great detail about how to use Payoneer in Pakistan before, but since those posts are quite old now, we decided to write a new post about how to use Payoneer in Pakistan in 2016.

Once you apply for the Payoneer card here:

1. ACTIVATE YOUR PAYONEER IN PAKISTAN

- Tear open the envelope you have received from Payoneer in the mail

- Unpack the card and take out the activation instructions letter

- Go to your PC

- Go to www.payoneer.com

- Click on Activate your card in the panel on the right

- Enter your account details to login to your Payoneer online account (these are the same details you chose when you ordered the card). The username is your email address and the password is what you chose it to be..

- Once you login, you will see a button you can click to activate your card. Click it!

- Enter the 16 digit card number located on your card, and choose a 4 digit pin number.

- Celebrate the activation of your card!

2. USE YOUR PAYONEER IN PAKISTAN

- Your Payoneer card can be used in thousands of locations across Pakistan

- You can withdraw money from selected ATM machines all over Pakistan.

- Keep reading for list of Payoneer ATMs in Pakistan

- View this list of MasterCard ATMs in Pakistan. Make sure you look out for the MasterCard LOGO on the machine before you insert your card

- Read on to see Payoneer ATM limit in Pakistan

- Remember that all transactions in Pakistani ATM machines are done in Pakistani Rupees.

- Remember: DO NOT CHECK ATM BALANCE FROM THE ATM but to check it online. Most machines in Pakistan do not support checking of balance of MasterCard cards, and your card could get stuck if you try.

- You can also use your Payoneer MasterCard debit card at any shop, petrol pump or restaurant that accepts MasterCard payments. All big stores etc accept this method of payment.

- You must enter in the AMOUNT IN RUPEES after converting the dollar amount that is in your card. You can only withdraw in rupees and not in dollars in Pakistan.

|

| Source: Payoneer.com |

WHICH ATMS DOES PAYONEER IN PAKISTAN WORK?

All MasterCard ATMs. Currently, the following banks support MasterCard ATM transactions:

- Bank Al Falah - no bank fee.

- Muslim Commercial Bank - MCB charges Rs. 250 fee

- Standard Chartered Bank - SCB charges Rs. 300 fee

- Royal Bank of Scotland (Faysal Bank) - Unsure about fee but it is not very reliable

- Citibank - Citibank only has a few branches and ATMs left in Pakistan

Here is a list of MasterCard ATMs in Pakistan

WHAT IS THE PAYONEER IN PAKISTAN TRANSACTION LIMIT?

The

per-transaction limit depends on the machine. Most MCB machines, all

Samba and all SCB machines allow users to withdraw Rs. 20,000 per

transaction.

There is no limit

on the number of transactions but different Payoneer cards have

withdrawal limits so you should check that out when ordering your card. Most cards have a daily withdrawal limit of USD 2,000 (meaning you can make around 10 transactions of PKR 20,000 per day).

Feel free to leave questions, comments and suggestions below and as always, I will try to answer them as soon as possible.